Note: The law has changed rapidly, and some of the original protections have expired. Please check more recently updated resources.

With many businesses closing or shifting to virtual work due to the novel coronavirus pandemic, it can be confusing as a worker to understand what the laws are surrounding your rights and benefits as an employee. Below is a summary of protections and wage-replacement options available to employees in various scenarios related to coronavirus.

-

If you are laid off, furloughed, or have hours cut:

Unemployment insurance is available to those who have lost their jobs or had their hours reduced through no fault of their own. Unemployment insurance benefits have been extended such that workers can collect them for up to 39 weeks. Workers are eligible for up to $450 weekly (based on wages earned), plus an additional $600 per week provided for by the CARES Act through July 31, 2020. While collecting unemployment, a person is not obligated to show that they are looking for work and the normal one-week waiting period has been waived.

Of note, unemployment benefits have been expanded to cover independent contractors, freelance workers, gig workers, and those who are self-employed. They will be eligible for the $600 per week in benefits provided for through the CARES Act.

Employees who were selected for layoff or had their hours cut because they have a disability or because of their age may have discrimination claims.

-

If you are forced to work in violation of state or local orders or retaliated against for refusing to do so:

The State of California, counties, and cities have issues orders restricting business operations to reduce the spread of the coronavirus. Employers that do not support sectors/industries deemed critical/essential may only operate remotely. Even those businesses deemed critical/essential must take steps to ensure that they are operating safely, and should allow employees to work remotely where feasible. For example, in Los Angeles, employers in certain essential businesses must provide employees with face coverings, allow for hand washing every 30 minutes, implement social distancing measures, and ensure that restrooms remain sanitary and stocked. An employer that requires employees to work in violation of these orders or retaliates against them for refusing to do so is in violation of California public policy and faces legal exposure for whistleblower retaliation.

-

If you miss work due to your own Covid-19-related illness or due to a medical quarantine:

Through 12/31/20, employees who miss work because they are sick with Covid-19 or subject to a quarantine may be eligible for up to 80 hours of paid sick leave through the Families First Coronavirus Relief Act (“FFCRA”), in addition to other sick leave they may have. The FFCRA applies to employers with fewer than 500 employees, and small employers (under 50 employees) may seek an exemption.

Employees who meet certain eligibility requirements (including that they worked at the employer for 1+ years, worked over 1250 hours in the past year, have 50 or more employees within 75 miles of their work site) also have protections under the California Family Rights Act (“CFRA”) and FMLA, which provide up to 12 weeks of job-protected but unpaid leave per year for the employee’s serious medical condition, to provide care for certain family members with a serious medical condition, or to bond with a baby/new child.

In addition, those who miss work due a Covid-19-related illness may be able to obtain disability insurance, which covers approximately 60-70 percent of wages (up to $1,300 per week) for up to one year (52 weeks).

-

If you are afraid to report to work because you or someone in your household is vulnerable:

Workers may have protections if they or someone in their household is at risk for severe coronavirus complications. In California, businesses with five or more employees have a obligation to provide disability-related reasonable accommodations to employees. If a worker is immunocompromised or has a pre-existing condition that makes them more vulnerable to Covid-19 complications (such as diabetes or high blood pressure), they can request a reasonable accommodation under the California Fair Employment and Housing Act (“FEHA”). For example, they may ask to work remotely where possible, may seek a modified schedule, or changes to the workplace environment. An employer must grant the accommodation request unless a reasonable alternative exists or they are able to prove that it would cause an undue hardship to do so.

California employers may also have obligations to provide disability accommodations to employees who are in a household with or care for a person who themselves has a disability and is at high risk for coronavirus complications.

It is important to note that an employer may not discriminate against a person based on age or disability, for example by selecting them for layoff or not permitting them to work because they see them as vulnerable to Covid-19.

-

If you miss work because you need to care for a child due to school closures:

Through 12/31/20, an employee who cannot report to work because they are caring for a child who is off from school may be eligible for up to twelve weeks of emergency family leave under the FFCRA. In addition, under Labor Code section 230.8, employees at worksites with more than 25 workers must be provided up to 40 hours of leave per year for school-related emergencies, including school or daycare closures.

-

If you miss work because you are caring for a family member who is ill or quarantined:

An employee who missing work to care for an ill or quarantined family member may be eligible for up to 80 hours of paid sick leave under FFCRA. In addition, they are eligible for Paid Family Leave through the EDD. This consists of up to six weeks of benefit payments. Like Disability Insurance, Paid Family Leave can cover approximately 60-70 percent of wages. Employees may also use the paid sick leave that they have accumulated under the Paid Sick Leave law or local laws.

-

If you are unable to work because you contracted COVID-19 while working:

Workers’ compensation benefits may be available for those who contracted Covid-19 at work. The employee may be eligible for up to 104 weeks of temporary disability (“TD”) payments, which start when the worker is hospitalized overnight or when their doctor says that they cannot perform their work for over three days. TD generally pays over half of the gross wages lost, up to a weekly maximum amount determined by law. If a worker becomes permanently disabled due to Covid-19, they are also entitled to additional payments and medical treatment. TD ends when the worker goes back to work, when their doctor determines that they can go back to work or have reached maximum improvement.

-

If you suffer retaliation for exercising your rights under these laws:

Employees are protected from retaliation from exercising their rights, including by requesting reasonable accommodations for a disability, exercising their leave rights, or speaking up about unsafe working conditions.

-

Additional Comments

Laws are rapidly changes and new benefits being created to help support workers and businesses during this difficult time.

More information for California workers seeking to understand their rights can be found at:

- The LWDA’s Coronavirus 2019 resources page;

- DFEH Employment Information on COVID-19 Fact Sheet;

- Department of Labor FFCRA Page and Frequently Asked Questions;

- Legal Aid at Work’s Coronavirus FAQ;

- CELA Voice: A Roundup of California Worker Rights in the Time of COVID-19; and

- Mizrahi Law Article Series: Top 10 Ways Employers Violate Medical Leave Rights.

* * *

Written by Ramit Mizrahi and Emma Broder.

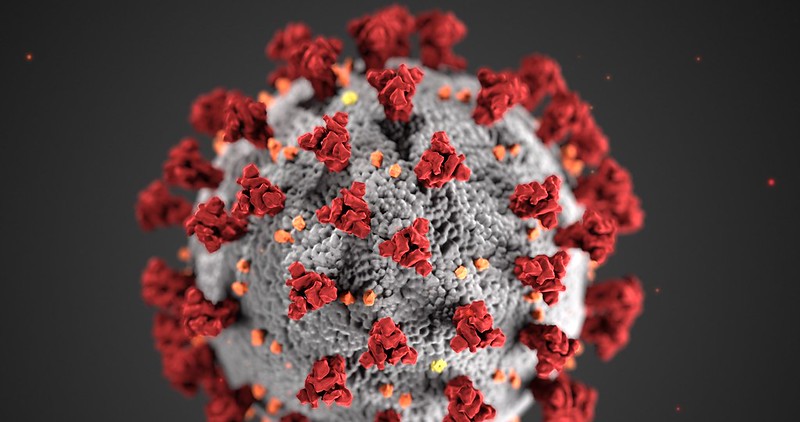

Photo credit: “Coronavirus” by Alachua County (public domain).